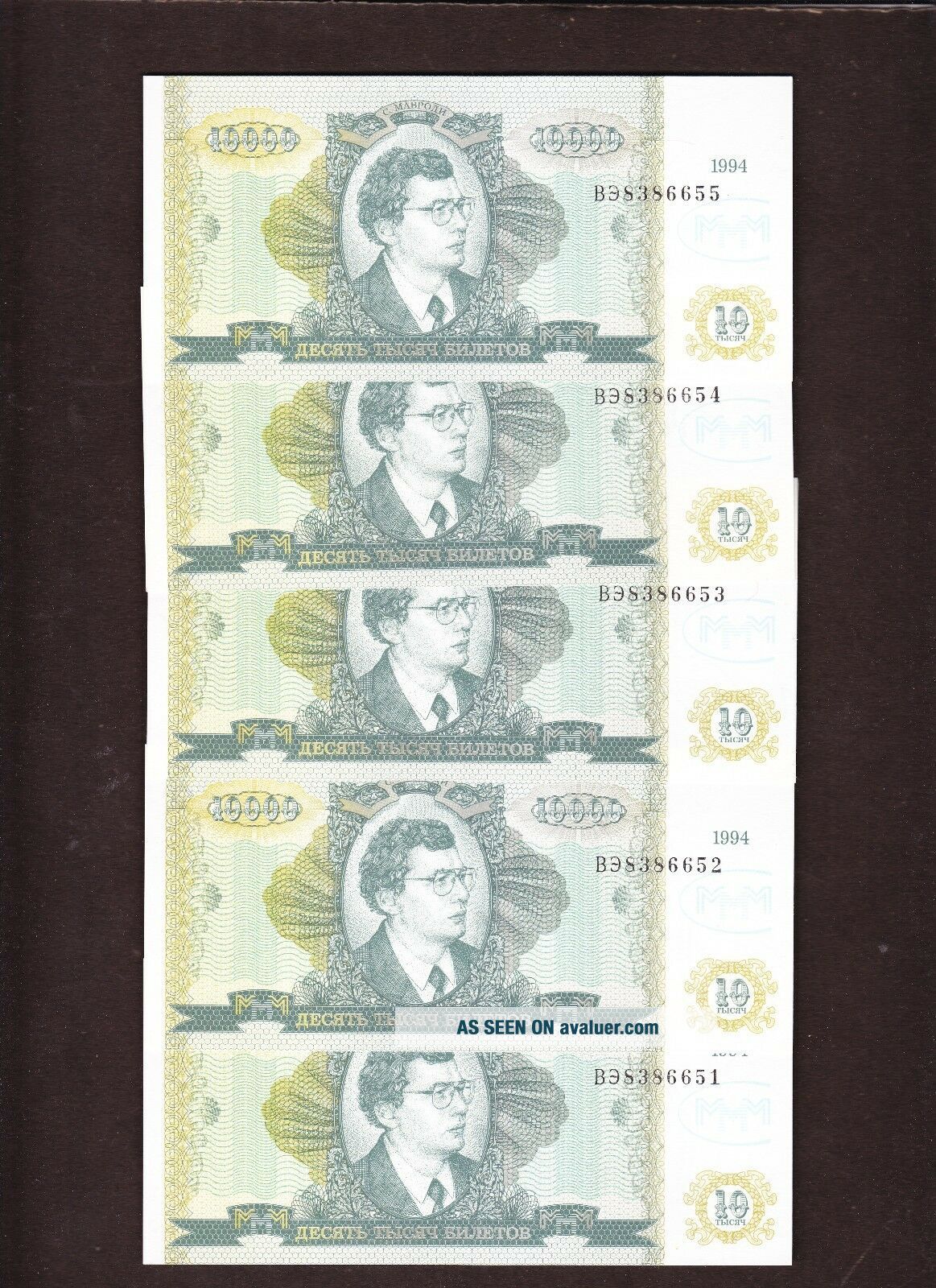

Russia 10, 000 Biletov 1994 Private Voucher - Shares - Note MMM Corp. UNC X 5

Item History & Price

| Reference Number: Avaluer:10254366 | Country: Russia |

| Year: 1994 | Type: Private currency |

| Circulated/Uncirculated: Uncirculated |

Five (5) private voucher notes of Russia 10, 000 biletov , 1994 MMM Corp. .Condition (opinion): Uncirculated (UNC) , see scan.See below for related information from the web.Portrait:Sergei Mavrodi.Watermark paper.............They were fractions of shares that bore the image of Sergei Mavrodi and came innumerous colours and denominations. One bilet was worth one-hundredth ofan MMM share and they were sold at one-hundredth the price of a share. The la...stadvertised price for the original issue of biletov in Pravda wason 28 July 1994, when Mavrodi was trying to sustain the value of his shares. TheMMM advertisement stated the day’s price for the biletov as 1, 340 rubles(sell) and 1, 250 rubles (buy), while projecting the price for 2 August to be1, 500 rubles (sell) and 1, 350 rubles (buy). The next advertisement inPravda on 2 August was for the second round of shares and thebiletov were never advertised again. The original biletovtherefore had a life of about two weeks. Later share issues, although sold asbiletov were always advertised as shares................... -------------------------------------------------------------------------Postage, including packing material, handling fees : Europe: USD 4.10 / USA $ 4.90. Rest of the World: USD 5.50 FREE of postage for any other additional banknote , stocks & bonds or other items .Only one shipping charge per shipment (the highest one) no matter how many items you buy (combined shipping).Guaranteed genuine-One month return policy for the banknotes (retail sales) .We invite our customers to combine purchases to save postage.Full refund policy , including shipping cost, guaranteed in case of lost or theft after the completion of the complaint with Spanish Correos for the registered letters (normally purchases above $ 30.00).Banknote Grading UNC AU EF VF F VG G Fair Poor Uncirculated About Uncirculated Extremely Fine Very Fine Fine Very Good Good Fair Poor Edges no counting marks light counting folds OR... light counting folds corners are not fully rounded much handling on edges rounded edges Folds no folds ...OR one light fold through center max. three light folds or one strong crease several horizontal and vertical folds many folds and creases Papercolor paper is clean with bright colors paper may have minimal dirt or some color smudging, but still crisp paper is not excessively dirty, but may have some softness paper may be dirty, discolored or stained very dirty, discolored and with some writing very dirty, discolorated, with writing and some obscured portions very dirty, discolored, with writing and obscured portions Tears no tears no tears into the border minor tears in the border, but out of design tears into the design Holes no holes no center hole, but staple hole usual center hole and staple hole Integrity no pieces missing no large pieces missing piece missing piece missing or tape

MMMCorporation

Peter Symes

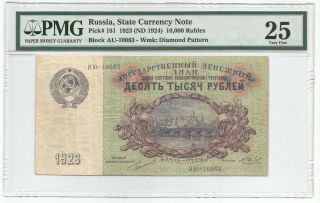

In post-communist Russia, great expectations wereheld for capitalism. After years of communist rule, many people expected thatthe benefits of capitalism would be immediately available to the citizens ofRussia. Although state-owned enterprises were being sold to investors wishing toexperiment with capitalism, there were very few controls to monitor the quicklydeveloping market economy. Unlike westerncountries, where legislation had been built up over centuries, to ensure probityamongst corporate financiers and public companies, in the first few years afterRussia dismissed the communist regime, a full range of legislation could not beenacted. This unsound environment allowed a number of speculative companies toarise, with one of the most famous being the MMM Corporation. The man behind the MMMCorporation was Sergei Mavrodi, a middle aged Russian who concocted a massivescheme to defraud millions of Russians of their savings. The other players inthe MMM Corporation are not clear. The initials of the company were evidentlyderived from the surnames of three of the directors of the corporation and it isprobable that the other people were relatives of Sergei Mavrodi. (One of thesignatories on the initial issue of investment certificates was ‘V. P. Mavrodi’, along with ‘S. [Sergei] P. Mavrodi’.) The MMM Corporationswindled the people of Russia by creating a huge pyramid scheme. A pyramidscheme takes investors money and offers to return interest on their money atunusually high rates. Investors are paid the interest as expected, but the moneyused to pay the interest is taken from the investment capital itself or fromdeposits obtained by subsequent investors. The money deposited by investors isnever actually used to invest in business or commercial enterprises, but issimply used to make interest payments on the investments. As long as the rate ofinvestors grows at a certain pace, each investor gets paid their interest andthey can even liquidate their entire investment. Of course the bubble burstswhen the interest payments required to be made become greater than the moneybeing deposited. The promoters of the scheme have an opportunity to use some ofthe investments as their personal wealth, although most of the money is used topay interest to make the scheme grow. If the scheme is well-managed thepromoters make most of their profit on the final round of investment, justbefore they disappear with the money! Such schemes are not newand, in the post-communist era, many such schemes flourished in the countries ofthe former Eastern Bloc. What makes the MMM Corporation of interest is that notonly were they one of the largest of the pyramid schemes, but they were alsoresponsible for issuing share certificates that looked very much likebanknotes. The origin of the MMMCorporation is not clear, nor when it commenced its business activities. Manyreports about MMM state that their activities commenced in 1991, but it appearsthat their large promotional activities and the implementation of the pyramidscheme began in February 1994. The active marketing of the Corporation was oneof the significant aspects of the scheme. Twice the Corporation paid for alltravel on the Moscow metro for a day. During the 1994 Soccer World Cup theysponsored the Russian football team and cornered as much as 40% of televisionadvertising in Russia during the event. Their aggressivemarketing program, particularly on state-run television, created much commentand their advertisements became the most well-known commercials in Russia. Inone advertisement, the Mexican soap-opera star, Victoria Ruffo, was manipulatedthrough computer graphics to endorse the MMM Corporation. The soap-opera inwhich Victoria Ruffo starred had been dubbed in Russian and was one of the mostpopular television programmes in Russia. The Corporation’s most famoustelevision advertisements portrayed a character called Lyonya Galubkov, aseemingly common man who had transformed his life by investing in the MMMCorporation. He was seen holidaying in San Francisco, buying an apartment inParis, and sometimes in conversation with his friend Ivan, with whom heexplained his success and defended his method of obtaining his wealth. Full-page advertisementsappeared in Pravda and Izvestia listing the current prices of theshares and addresses where the shares could be bought. Accompanying theadvertisements were cartoons showing how people had achieved almost instantwealth by investing in MMM shares. Small advertisements showing the current andprojected buying and selling prices of the shares were published on the frontpages of the major Russian newspapers. The MMM Corporationoffered very attractive returns over the commercial banks in Russia. As well asoffering better interest rates, the banks themselves had been unstable in someinstances, so many people were encouraged to take their savings from the banksand deposit them with the Corporation. By July 1994, when the house of cardsbegan to totter, it was estimated that between five and ten million people hadinvested in the MMM Corporation. Investors came not just from Russia, but alsofrom former Eastern Bloc countries such as Bulgaria, where agencies sold theshares of the Corporation. With a promise by the MMM Corporation to pay weeklyinterest of 10% on their shares, the temptation for people to invest largeamounts of money was too great, especially when it was seen that people werereceiving payments on their investments. Although the Russianauthorities had investigated the Corporation and its associated companies onseveral occasions, they had done nothing to alert people to the issuessurrounding the Corporation’s activities. Simply put, a pyramid scheme was notillegal in Russia and they were legally selling shares; although it was laterreported that they had sold far more shares than they were permitted to sell andtheir promotion of part-shares (see below) was also seen to be contrary tolegislation. When questioned as to how they were able to sustain such highreturns on investments, spokesmen for the Corporation stated (when they could befound) that they had solid investments, but they did not wish to disclose theirinvestment policies for fear their competitors might take advantage of them. Several Russianpoliticians stated that they had reservations about the Corporation and othersopenly stated that they would not invest in such a company. In July 1994 theMinistry of Finance finally issued statements warning about the nature of theMMM Corporation and the impossibility of the situation being sustained to asuccessful outcome for all investors. These statements caused many people tocash in their investments and a run on the Corporation commenced. At this timeit was estimated that some 10 trillion rubles had been invested in MMM shares, which was then equivalent to US$1.7 billion. The price of MMM shareshad risen from 1, 600 rubles in February 1994 to around 115, 000 rubles in lateJuly the same year. At that time, 1, 600 rubles was worth about US$1.00. By earlyJuly the shares had become so expensive that Mavrodi decided to issuepart-shares. These part-shares, which were known as biletov but sometimesreferred to as ‘Movrodki’, were made available from mid July, at the height ofthe frenzy. The first advertisedprice of the biletov appeared in Izvestia on 14 July. The sellingprice was 905 rubles and the buying price 870 rubles. These prices wereone-hundredth of the price of a share and this ratio between the prices ofbiletov and shares continued for the short life of the biletov, which saw their demise when the run on MMM shares commenced. As soon as the runbegan, it became apparent that Mavrodi’s tactics were to pay claims, but to paythem at such a slow rate that no great amount of money would be paid out. Thisresulted in the closing of all but one of his offices on 26 July. (There weresixty offices in Moscow and a further seventy-six offices in forty-nine citiesacross Russia.) At the one office that remained open, a crowd of severalthousand people queued to have their shares paid out. Although most shareholderswaited for several days, before it became obvious that their money haddisappeared, there were numerous reports of senior military personnel and knowncriminals walking into the office of MMM and having their investments cashed.Such behaviour was already common in Russian society, but it did appear that thepayment of officials and criminals was a way whereby Mavrodi hoped to savehimself. The Corporation claimedthat the run on the company had forced them into closing most of their officesand limiting payments, but they remained confident that things would improve.Sergei Mavrodi was openly critical of the government, claiming that they wereresponsible for the situation in which the MMM Corporation found itself. Mavrodi was reported assaying of his shareholders: ‘It is obvious a new political force has appeared inRussia and it is so powerful that now it would hardly be possible to oppose it.’He tried to threaten the authorities by implying that, if his company wasseriously affected, civil unrest might break out. Mavrodi maintained the supportof many investors as the edifice of the MMM Corporation crumbled. A number ofinvestors firmly believed that the collapse was due to the government and thatMavrodi was a victim of the wiles of officialdom. Mavrodi’s protestationsof innocence, and of the wrongdoings of the government, were short lived. On 7August 1994, the man at the head of the Corporation, who had become the sixthrichest man in Russia, was arrested for the failure of ‘Invest Corporation’, oneof his companies, to pay the equivalent of US$25 million in taxes. Petitionsfrom MMM shareholders to President Yeltsin sought the release of Mavrodi so thathe might compensate shareholders. It was also suggested that the Russiangovernment, MMM, and the Union of MMM Shareholders might join together toarrange compensation for shareholders. However, Prime Minister VictorChernomyrdin stated that MMM (and similar organizations) had been violatinglegislation and that the government would not undertake to compensateshareholders for any loss. Held in jail, awaitingthe conclusion of the investigation into his activities, Mavrodi continued tooversee his business activities. Shortly after the run on MMM shares commenced, Mavrodi had suspended trading in his shares and the biletov. He thenambitiously chose to commence a second issue of shares, priced at 950 rubles(about $0.50), which he promised would be redeemed for 1, 050 rubles in thefollowing week. These new shares were promoted by the MMM corporation untilearly October 1994, rising steadily to a selling price of 3, 635 rubles on 6September. On 5 October, in what appears to be the final full-page advertisementin Pravda, the new shares were quoted at the fantastic selling price of16, 535 rubles. This huge increase in the price of the shares appears to havebeen Mavrodi’s attempt to sell one final round of shares before closing down hisoperation. While in jail, Mavrodidecided to seek asylum in the Russian Parliament. Members of the ‘Duma’ areimmune from prosecution under the Russian constitution and so Mavrodi sought aseat in a Duma by-election. With election promises based on provision ofservices to the electorate through his personal wealth, Mavrodi swept to victoryon a voter turnout of only 30%. During the electioncampaign Mavrodi promised that, if elected, he would commence buying the shareswhich had been suspended several months earlier. Two days after being elected, on 31 October 1994, he announced via loudspeakers outside his Moscow officesthat the earlier shares would not be bought back until after 1 January 1995. Hethen announced that a completely new set of shares would be issued, commencingwith a price of 1000 rubles and rising to 1, 270 rubles on Friday of the sameweek. Despite being ‘bitten’ by Mavrodi in the past, many people began to queuefor the shares of the third issue. Ultimately, Mavrodi wasexpelled from the Duma in October 1995 and thus had his immunity fromprosecution removed. He subsequently sought re-election in the December 1995elections of the Duma, but failed to get re-elected. Prior to the election, theCentral Electoral Commission had refused to register his ‘Party of People’sCapital’, because Mavrodi had stated that only members of his new politicalparty would be repaid their investment in MMM shares. In early September 1997an arbitration court in Moscow declared the MMM fund bankrupt, following a courtcase brought by two investors. In February 1997 Pallada Asset Management inMoscow was entrusted with the responsibility of managing a federal fund set upto compensate victims of numerous pyramid schemes that had wracked theinvestment economy of Russia, of which the MMM Corporation was the largest. Thegovernment had come under pressure to compensate MMM shareholders, with itsfailure to adequately control the activities of this and similar organizations.Apart from failing to regulate investment organizations, state-controlledtelevision had shown advertisements for the MMM Corporation, and this was seenby many people as tantamount to support by the government for the legitimacy ofthe Corporation’s activities, at the time they were broadcast. This implied apartial responsibility of the government for losses by investors. In 1998 a warrant wasissued for the arrest of Mavrodi, who seemed to have disappeared. However, on 9July 2000 the U.S. Securities and Exchange Commission brought a suit against‘Stockgeneration’, a company based in the Dominican Republic. Using the internetas their promotional medium, Stockgeneration had promised some 275, 000 investorsin the United States up to 215% annual interest. In bringing their suit againstStockgeneration, the U.S. Securities and Exchange Commission declared that thecompany had constructed a classic pyramid scheme. It was reported that two ofthe principals behind Stockgeneration were Sergei Mavrodi and his cousin OskanaPavlyuchenko. This is the story ofSergei Mavrodi and the MMM Corporation. So where do the banknote-like ‘notes’illustrated on this site (see links below) fit into the schemes of Mavrodi?Firstly, they are not the shares that were initially sold by the MMMCorporation.

MMMCorporation

Peter Symes

In post-communist Russia, great expectations wereheld for capitalism. After years of communist rule, many people expected thatthe benefits of capitalism would be immediately available to the citizens ofRussia. Although state-owned enterprises were being sold to investors wishing toexperiment with capitalism, there were very few controls to monitor the quicklydeveloping market economy. Unlike westerncountries, where legislation had been built up over centuries, to ensure probityamongst corporate financiers and public companies, in the first few years afterRussia dismissed the communist regime, a full range of legislation could not beenacted. This unsound environment allowed a number of speculative companies toarise, with one of the most famous being the MMM Corporation. The man behind the MMMCorporation was Sergei Mavrodi, a middle aged Russian who concocted a massivescheme to defraud millions of Russians of their savings. The other players inthe MMM Corporation are not clear. The initials of the company were evidentlyderived from the surnames of three of the directors of the corporation and it isprobable that the other people were relatives of Sergei Mavrodi. (One of thesignatories on the initial issue of investment certificates was ‘V. P. Mavrodi’, along with ‘S. [Sergei] P. Mavrodi’.) The MMM Corporationswindled the people of Russia by creating a huge pyramid scheme. A pyramidscheme takes investors money and offers to return interest on their money atunusually high rates. Investors are paid the interest as expected, but the moneyused to pay the interest is taken from the investment capital itself or fromdeposits obtained by subsequent investors. The money deposited by investors isnever actually used to invest in business or commercial enterprises, but issimply used to make interest payments on the investments. As long as the rate ofinvestors grows at a certain pace, each investor gets paid their interest andthey can even liquidate their entire investment. Of course the bubble burstswhen the interest payments required to be made become greater than the moneybeing deposited. The promoters of the scheme have an opportunity to use some ofthe investments as their personal wealth, although most of the money is used topay interest to make the scheme grow. If the scheme is well-managed thepromoters make most of their profit on the final round of investment, justbefore they disappear with the money! Such schemes are not newand, in the post-communist era, many such schemes flourished in the countries ofthe former Eastern Bloc. What makes the MMM Corporation of interest is that notonly were they one of the largest of the pyramid schemes, but they were alsoresponsible for issuing share certificates that looked very much likebanknotes. The origin of the MMMCorporation is not clear, nor when it commenced its business activities. Manyreports about MMM state that their activities commenced in 1991, but it appearsthat their large promotional activities and the implementation of the pyramidscheme began in February 1994. The active marketing of the Corporation was oneof the significant aspects of the scheme. Twice the Corporation paid for alltravel on the Moscow metro for a day. During the 1994 Soccer World Cup theysponsored the Russian football team and cornered as much as 40% of televisionadvertising in Russia during the event. Their aggressivemarketing program, particularly on state-run television, created much commentand their advertisements became the most well-known commercials in Russia. Inone advertisement, the Mexican soap-opera star, Victoria Ruffo, was manipulatedthrough computer graphics to endorse the MMM Corporation. The soap-opera inwhich Victoria Ruffo starred had been dubbed in Russian and was one of the mostpopular television programmes in Russia. The Corporation’s most famoustelevision advertisements portrayed a character called Lyonya Galubkov, aseemingly common man who had transformed his life by investing in the MMMCorporation. He was seen holidaying in San Francisco, buying an apartment inParis, and sometimes in conversation with his friend Ivan, with whom heexplained his success and defended his method of obtaining his wealth. Full-page advertisementsappeared in Pravda and Izvestia listing the current prices of theshares and addresses where the shares could be bought. Accompanying theadvertisements were cartoons showing how people had achieved almost instantwealth by investing in MMM shares. Small advertisements showing the current andprojected buying and selling prices of the shares were published on the frontpages of the major Russian newspapers. The MMM Corporationoffered very attractive returns over the commercial banks in Russia. As well asoffering better interest rates, the banks themselves had been unstable in someinstances, so many people were encouraged to take their savings from the banksand deposit them with the Corporation. By July 1994, when the house of cardsbegan to totter, it was estimated that between five and ten million people hadinvested in the MMM Corporation. Investors came not just from Russia, but alsofrom former Eastern Bloc countries such as Bulgaria, where agencies sold theshares of the Corporation. With a promise by the MMM Corporation to pay weeklyinterest of 10% on their shares, the temptation for people to invest largeamounts of money was too great, especially when it was seen that people werereceiving payments on their investments. Although the Russianauthorities had investigated the Corporation and its associated companies onseveral occasions, they had done nothing to alert people to the issuessurrounding the Corporation’s activities. Simply put, a pyramid scheme was notillegal in Russia and they were legally selling shares; although it was laterreported that they had sold far more shares than they were permitted to sell andtheir promotion of part-shares (see below) was also seen to be contrary tolegislation. When questioned as to how they were able to sustain such highreturns on investments, spokesmen for the Corporation stated (when they could befound) that they had solid investments, but they did not wish to disclose theirinvestment policies for fear their competitors might take advantage of them. Several Russianpoliticians stated that they had reservations about the Corporation and othersopenly stated that they would not invest in such a company. In July 1994 theMinistry of Finance finally issued statements warning about the nature of theMMM Corporation and the impossibility of the situation being sustained to asuccessful outcome for all investors. These statements caused many people tocash in their investments and a run on the Corporation commenced. At this timeit was estimated that some 10 trillion rubles had been invested in MMM shares, which was then equivalent to US$1.7 billion. The price of MMM shareshad risen from 1, 600 rubles in February 1994 to around 115, 000 rubles in lateJuly the same year. At that time, 1, 600 rubles was worth about US$1.00. By earlyJuly the shares had become so expensive that Mavrodi decided to issuepart-shares. These part-shares, which were known as biletov but sometimesreferred to as ‘Movrodki’, were made available from mid July, at the height ofthe frenzy. The first advertisedprice of the biletov appeared in Izvestia on 14 July. The sellingprice was 905 rubles and the buying price 870 rubles. These prices wereone-hundredth of the price of a share and this ratio between the prices ofbiletov and shares continued for the short life of the biletov, which saw their demise when the run on MMM shares commenced. As soon as the runbegan, it became apparent that Mavrodi’s tactics were to pay claims, but to paythem at such a slow rate that no great amount of money would be paid out. Thisresulted in the closing of all but one of his offices on 26 July. (There weresixty offices in Moscow and a further seventy-six offices in forty-nine citiesacross Russia.) At the one office that remained open, a crowd of severalthousand people queued to have their shares paid out. Although most shareholderswaited for several days, before it became obvious that their money haddisappeared, there were numerous reports of senior military personnel and knowncriminals walking into the office of MMM and having their investments cashed.Such behaviour was already common in Russian society, but it did appear that thepayment of officials and criminals was a way whereby Mavrodi hoped to savehimself. The Corporation claimedthat the run on the company had forced them into closing most of their officesand limiting payments, but they remained confident that things would improve.Sergei Mavrodi was openly critical of the government, claiming that they wereresponsible for the situation in which the MMM Corporation found itself. Mavrodi was reported assaying of his shareholders: ‘It is obvious a new political force has appeared inRussia and it is so powerful that now it would hardly be possible to oppose it.’He tried to threaten the authorities by implying that, if his company wasseriously affected, civil unrest might break out. Mavrodi maintained the supportof many investors as the edifice of the MMM Corporation crumbled. A number ofinvestors firmly believed that the collapse was due to the government and thatMavrodi was a victim of the wiles of officialdom. Mavrodi’s protestationsof innocence, and of the wrongdoings of the government, were short lived. On 7August 1994, the man at the head of the Corporation, who had become the sixthrichest man in Russia, was arrested for the failure of ‘Invest Corporation’, oneof his companies, to pay the equivalent of US$25 million in taxes. Petitionsfrom MMM shareholders to President Yeltsin sought the release of Mavrodi so thathe might compensate shareholders. It was also suggested that the Russiangovernment, MMM, and the Union of MMM Shareholders might join together toarrange compensation for shareholders. However, Prime Minister VictorChernomyrdin stated that MMM (and similar organizations) had been violatinglegislation and that the government would not undertake to compensateshareholders for any loss. Held in jail, awaitingthe conclusion of the investigation into his activities, Mavrodi continued tooversee his business activities. Shortly after the run on MMM shares commenced, Mavrodi had suspended trading in his shares and the biletov. He thenambitiously chose to commence a second issue of shares, priced at 950 rubles(about $0.50), which he promised would be redeemed for 1, 050 rubles in thefollowing week. These new shares were promoted by the MMM corporation untilearly October 1994, rising steadily to a selling price of 3, 635 rubles on 6September. On 5 October, in what appears to be the final full-page advertisementin Pravda, the new shares were quoted at the fantastic selling price of16, 535 rubles. This huge increase in the price of the shares appears to havebeen Mavrodi’s attempt to sell one final round of shares before closing down hisoperation. While in jail, Mavrodidecided to seek asylum in the Russian Parliament. Members of the ‘Duma’ areimmune from prosecution under the Russian constitution and so Mavrodi sought aseat in a Duma by-election. With election promises based on provision ofservices to the electorate through his personal wealth, Mavrodi swept to victoryon a voter turnout of only 30%. During the electioncampaign Mavrodi promised that, if elected, he would commence buying the shareswhich had been suspended several months earlier. Two days after being elected, on 31 October 1994, he announced via loudspeakers outside his Moscow officesthat the earlier shares would not be bought back until after 1 January 1995. Hethen announced that a completely new set of shares would be issued, commencingwith a price of 1000 rubles and rising to 1, 270 rubles on Friday of the sameweek. Despite being ‘bitten’ by Mavrodi in the past, many people began to queuefor the shares of the third issue. Ultimately, Mavrodi wasexpelled from the Duma in October 1995 and thus had his immunity fromprosecution removed. He subsequently sought re-election in the December 1995elections of the Duma, but failed to get re-elected. Prior to the election, theCentral Electoral Commission had refused to register his ‘Party of People’sCapital’, because Mavrodi had stated that only members of his new politicalparty would be repaid their investment in MMM shares. In early September 1997an arbitration court in Moscow declared the MMM fund bankrupt, following a courtcase brought by two investors. In February 1997 Pallada Asset Management inMoscow was entrusted with the responsibility of managing a federal fund set upto compensate victims of numerous pyramid schemes that had wracked theinvestment economy of Russia, of which the MMM Corporation was the largest. Thegovernment had come under pressure to compensate MMM shareholders, with itsfailure to adequately control the activities of this and similar organizations.Apart from failing to regulate investment organizations, state-controlledtelevision had shown advertisements for the MMM Corporation, and this was seenby many people as tantamount to support by the government for the legitimacy ofthe Corporation’s activities, at the time they were broadcast. This implied apartial responsibility of the government for losses by investors. In 1998 a warrant wasissued for the arrest of Mavrodi, who seemed to have disappeared. However, on 9July 2000 the U.S. Securities and Exchange Commission brought a suit against‘Stockgeneration’, a company based in the Dominican Republic. Using the internetas their promotional medium, Stockgeneration had promised some 275, 000 investorsin the United States up to 215% annual interest. In bringing their suit againstStockgeneration, the U.S. Securities and Exchange Commission declared that thecompany had constructed a classic pyramid scheme. It was reported that two ofthe principals behind Stockgeneration were Sergei Mavrodi and his cousin OskanaPavlyuchenko. This is the story ofSergei Mavrodi and the MMM Corporation. So where do the banknote-like ‘notes’illustrated on this site (see links below) fit into the schemes of Mavrodi?Firstly, they are not the shares that were initially sold by the MMMCorporation.