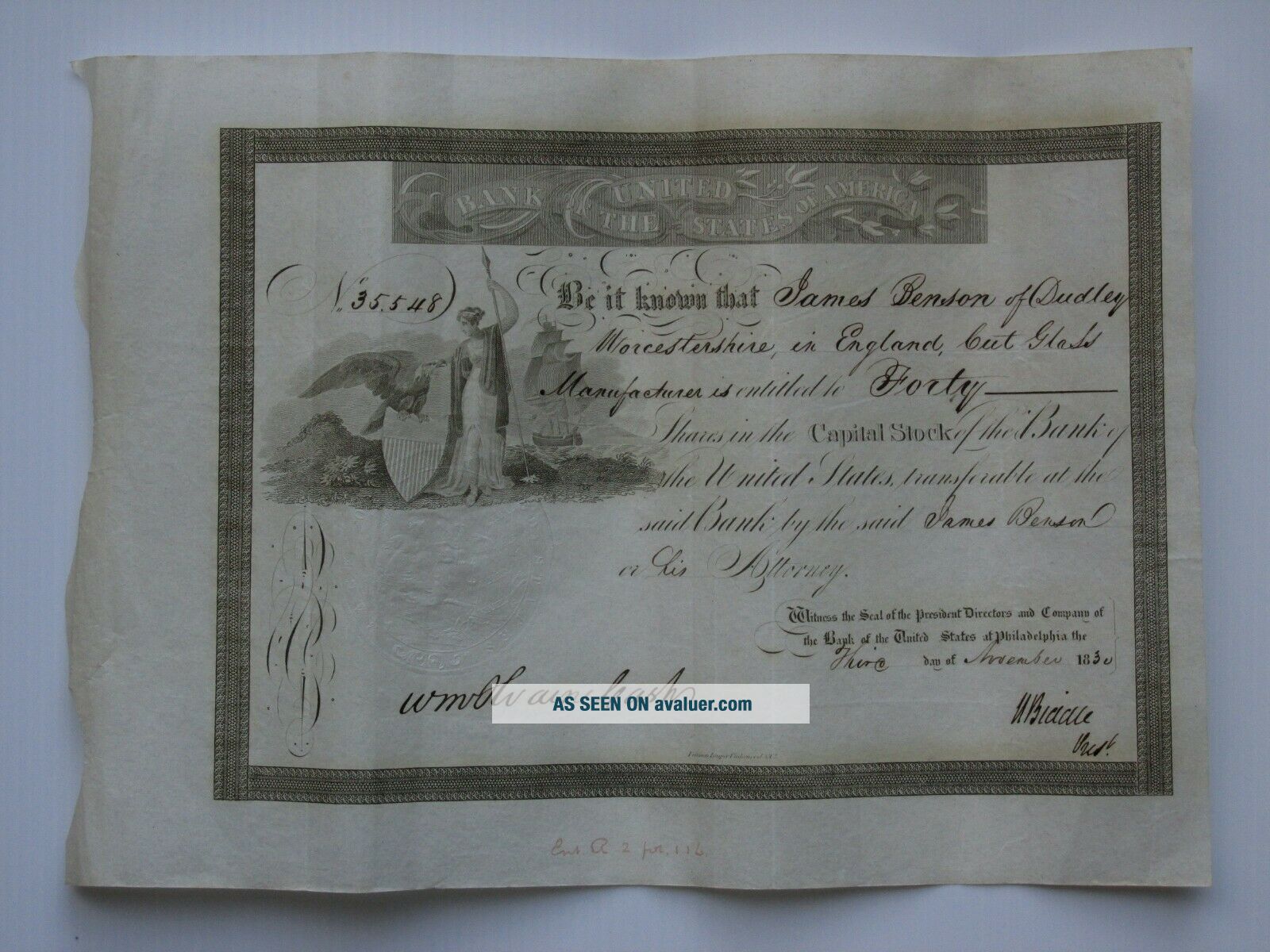

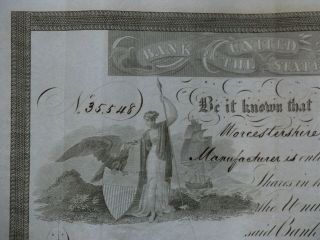

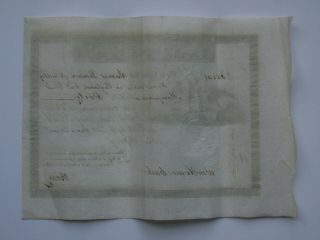

1830 Bank Of The United States Of America - Signed By Nicholas Biddle

Item History & Price

| Reference Number: Avaluer:4484310 |

an historic piece of USA financial history and 189 years old!!!

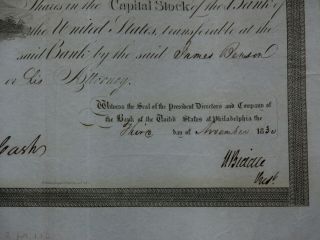

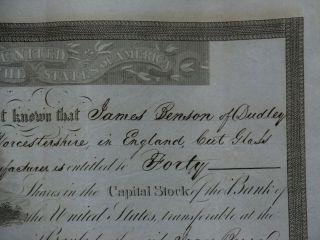

stock certificate no.35548 for 40 shares issued to James Benson of Dudley 'Cut Glass Manufacturer'

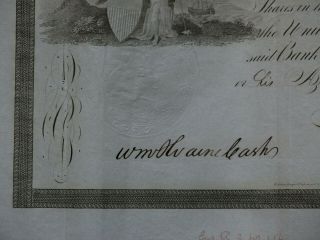

a scarce stock in VERY good condition (hence the price) with a nice clear, hand signed signature of Nicholas Biddle

shipping is $11.75 for Royal Mail Tracked & Signed, multiple purchases are posted together at no further cost - please note, I do not profit from shipping

from wikipedia

Nicholas Biddle&nbs...p;(January 8, 1786 – February 27, 1844) was an American financier who served as the third and last president of the Second Bank of the United States (chartered 1816–1836). He also served in the Pennsylvania General Assembly. He is best known for his role in the Bank War.A member of the prominent Biddle family of Philadelphia, Nicholas Biddle worked for prominent officials such as John Armstrong Jr. and James Monroe in his youth. After returning to Philadelphia, he won election to the state legislature. While serving in the legislature, he successfully lobbied Congress and President Monroe for the creation of a new central bank, which became known as the Second Bank of the United States. In 1822, Monroe appointed Biddle as the third president of the bank. Biddle would continue to serve as the bank's president for several years, during which time he exercised power over the nation's money supply and interest rates, seeking to prevent economic crises.At the request of Henry Clay and other Whigs, Biddle asked Democratic President Andrew Jackson to renew the bank's federal charter in 1832. Jackson, who held a deep hostility to many banks, declined to renew the charter, beginning a political debate known as the Bank War. When Jackson transferred the federal government's deposits to several state banks, Biddle raised interest rates, causing a mild economic recession. The federal charter expired in 1836, but the bank was re-chartered by Pennsylvania. Biddle continued to serve as president of the bank until 1839.After Biddle moved to the Pennsylvania State Senate, he lobbied for the rechartering of the Second Bank of the United States. It was on this subject that he made his first speech, which attracted general attention at the time, and was warmly commended by Chief-Justice Marshall and other leaders of public opinion.[1]The Bank had been revived and reorganized from the earlier First Bank of the United States, established in 1791 under the administration of first President George Washington, and after a chartered term of 20 years, expired in 1811 on the eve of the monetary pressures of the coming War of 1812 era. After economic hardships and problems financing the Government and its war measures during the War of 1812 to 1815, and a period of dormancy, a newly revived and reorganized Second Bank of the United States was rechartered in 1816 under fifth President James Monroe, who appointed Biddle as a Federal Government director and representative. When the Bank's president, Langdon Cheves, resigned in 1822, Biddle became its president.[citation needed] During his association with the Bank, President Monroe, under authority from Congress, directed him to prepare a "Commercial Digest" of the laws and trade regulations of the world and the various nations. For many years after, this Digest was regarded as an authority on the subject.[1]In late 1818, $4 million of interest payments on the bonds previously sold in 1803 to pay for the "Louisiana Purchase" was due, in either gold or silver, to European investors. The U.S. Government had to get its hands on additional amounts of specie, i.e., silver or gold. As the Government's fiscal agent, the Bank was required to make this payment on behalf of the Government. The Bank was forced to demand that the private commercial banks that had been lent money in the form of "fiat" paper must now repay in specie, which was then sent to Europe to pay the government's creditors. This rather sudden contraction of the country's monetary base after three currency and rampant speculation based on debt led to the financial Panic of 1819.[citation needed]Meanwhile, in Tennessee, General and future Presidential candidate, Andrew Jackson was hard-pressed to pay his debts during this period. He developed a lifelong hostility to all banks that were not completely backed by gold or silver deposits. This meant, above all, hostility to the new Second Bank of the United States.[citation needed].As Bank president, Biddle occasionally engaged in the newly-developing national techniques of "central banking" – controlling the nation's money supply, regulating interest rates, lending to state banks, and acting as the U.S. Government's fiscal agent. When state banks became excessive in their lending practices, Biddle's Bank acted as a restraint. In a few instances, he even rescued state banks to prevent the risk of "contagion" spreading. He was also important in the 1833 establishment of Girard College, an early free private school for poor orphaned boys in Philadelphia, under the provisions of the will of his friend and former legal client, Stephen Girard (1750–1831), one of the wealthiest men in America. Girard had been the original promoter of the revival and reorganization of the Second Bank and its largest investor.[7]On August 26, 1831, Biddle's brother, Thomas, a War of 1812 veteran, was killed in a duel on "Bloody Island" on the Mississippi River at St. Louis, Missouri with U.S. Representative (Congressman) Spencer Pettis. Thomas had taken offense to Pettis' criticizing Nicholas at the bank. After an exchange of letters to the editor of a newspaper, Biddle accosted an ill Pettis in his hotel room. After Pettis recovered, he then challenged Thomas to a duel, and both were killed when they exchanged shots from five feet apart.[8]

Bank War[edit]The Bank War began when seventh President Andrew Jackson began criticizing the Bank early in his first term. Biddle, at the urging of Henry Clay and other Bank supporters, upped the ante when he applied for the Bank's re-charter in January 1832.[1] This was four years before the charter was scheduled to expire at the end of two decades, and the hope was to force Jackson into making an unpopular decision that might cost him during an election year. But, once challenged, President Jackson decided to veto the bill anyway. Jackson, well known for his stubborn personality and steadfast leadership, still harbored ill-will toward Henry Clay of Kentucky from the earlier "Corrupt Bargain" accusation following the Presidential Election of 1824 which made him Secretary of State when appointed by the administration of the winner, sixth President John Quincy Adams.At Biddle's direction, the Bank poured thousands of dollars into a campaign to defeat Jackson in the 1832 election. Biddle was told that this would only give credence to Jackson's theory that the Bank interfered in the American political process, but chose to dismiss the warning.[9] Ultimately, Clay's strategy failed, and in November he lost to Jackson, who was reelected to a second term.In early 1833, Jackson, despite opposition from some members of his cabinet, decided to withdraw the Government's funds from the Bank.[10] The incumbent Secretary of the Treasury, Louis McLane, a member of Jackson's Cabinet, professed moderate support for the Bank. He therefore refused to withdraw the Federal funds directed by the President and would not resign, so Jackson then transferred him to the State Department.[11] McLane's successor, William J. Duane, was also opposed to the Bank, but would not carry out Jackson's orders either. After waiting four months, President Jackson summarily dismissed Duane, replacing him with Attorney General Roger B. Taney as a recess appointment when Congress was out of session.[12] In September 1833, Taney helped transfer the public deposits from the Bank to seven state-chartered banks. Faced with the loss of the Federal deposits, Biddle decided to raise interest rates and deliberately induce a recession. A mild financial panic ensued from late 1833 to mid-1834.[13] Intended to force Jackson into a compromise, the move backfired, increasing anti-Bank sentiment.[14][13] Meanwhile, Biddle and other Bank supporters attempted to renew the Bank's charter through the Congress on numerous occasions. All their attempts failed under the threat of a Jackson presidential veto.[13]Demise of the bank[edit]Finally, after the requisite twenty-year term, the Bank's charter expired in April 1836, but the financial institution continued as a state-chartered bank under the laws of Pennsylvania for several more years. As the Bank wound up its operations in the next five years, state-chartered banks in the West and South relaxed their lending standards, maintaining unsafe reserve ratios and contributing to the Panic of 1837. In 1839 Biddle resigned from his post as bank president, and in 1841, amidst the post-Panic recession, the Bank finally failed. Biddle was arrested and charged with fraud, but was acquitted.[citation needed] He died soon after, on February 27, 1844, [15] while still involved in the ensuing civil suits.

stock certificate no.35548 for 40 shares issued to James Benson of Dudley 'Cut Glass Manufacturer'

a scarce stock in VERY good condition (hence the price) with a nice clear, hand signed signature of Nicholas Biddle

shipping is $11.75 for Royal Mail Tracked & Signed, multiple purchases are posted together at no further cost - please note, I do not profit from shipping

from wikipedia

Nicholas Biddle&nbs...p;(January 8, 1786 – February 27, 1844) was an American financier who served as the third and last president of the Second Bank of the United States (chartered 1816–1836). He also served in the Pennsylvania General Assembly. He is best known for his role in the Bank War.A member of the prominent Biddle family of Philadelphia, Nicholas Biddle worked for prominent officials such as John Armstrong Jr. and James Monroe in his youth. After returning to Philadelphia, he won election to the state legislature. While serving in the legislature, he successfully lobbied Congress and President Monroe for the creation of a new central bank, which became known as the Second Bank of the United States. In 1822, Monroe appointed Biddle as the third president of the bank. Biddle would continue to serve as the bank's president for several years, during which time he exercised power over the nation's money supply and interest rates, seeking to prevent economic crises.At the request of Henry Clay and other Whigs, Biddle asked Democratic President Andrew Jackson to renew the bank's federal charter in 1832. Jackson, who held a deep hostility to many banks, declined to renew the charter, beginning a political debate known as the Bank War. When Jackson transferred the federal government's deposits to several state banks, Biddle raised interest rates, causing a mild economic recession. The federal charter expired in 1836, but the bank was re-chartered by Pennsylvania. Biddle continued to serve as president of the bank until 1839.After Biddle moved to the Pennsylvania State Senate, he lobbied for the rechartering of the Second Bank of the United States. It was on this subject that he made his first speech, which attracted general attention at the time, and was warmly commended by Chief-Justice Marshall and other leaders of public opinion.[1]The Bank had been revived and reorganized from the earlier First Bank of the United States, established in 1791 under the administration of first President George Washington, and after a chartered term of 20 years, expired in 1811 on the eve of the monetary pressures of the coming War of 1812 era. After economic hardships and problems financing the Government and its war measures during the War of 1812 to 1815, and a period of dormancy, a newly revived and reorganized Second Bank of the United States was rechartered in 1816 under fifth President James Monroe, who appointed Biddle as a Federal Government director and representative. When the Bank's president, Langdon Cheves, resigned in 1822, Biddle became its president.[citation needed] During his association with the Bank, President Monroe, under authority from Congress, directed him to prepare a "Commercial Digest" of the laws and trade regulations of the world and the various nations. For many years after, this Digest was regarded as an authority on the subject.[1]In late 1818, $4 million of interest payments on the bonds previously sold in 1803 to pay for the "Louisiana Purchase" was due, in either gold or silver, to European investors. The U.S. Government had to get its hands on additional amounts of specie, i.e., silver or gold. As the Government's fiscal agent, the Bank was required to make this payment on behalf of the Government. The Bank was forced to demand that the private commercial banks that had been lent money in the form of "fiat" paper must now repay in specie, which was then sent to Europe to pay the government's creditors. This rather sudden contraction of the country's monetary base after three currency and rampant speculation based on debt led to the financial Panic of 1819.[citation needed]Meanwhile, in Tennessee, General and future Presidential candidate, Andrew Jackson was hard-pressed to pay his debts during this period. He developed a lifelong hostility to all banks that were not completely backed by gold or silver deposits. This meant, above all, hostility to the new Second Bank of the United States.[citation needed].As Bank president, Biddle occasionally engaged in the newly-developing national techniques of "central banking" – controlling the nation's money supply, regulating interest rates, lending to state banks, and acting as the U.S. Government's fiscal agent. When state banks became excessive in their lending practices, Biddle's Bank acted as a restraint. In a few instances, he even rescued state banks to prevent the risk of "contagion" spreading. He was also important in the 1833 establishment of Girard College, an early free private school for poor orphaned boys in Philadelphia, under the provisions of the will of his friend and former legal client, Stephen Girard (1750–1831), one of the wealthiest men in America. Girard had been the original promoter of the revival and reorganization of the Second Bank and its largest investor.[7]On August 26, 1831, Biddle's brother, Thomas, a War of 1812 veteran, was killed in a duel on "Bloody Island" on the Mississippi River at St. Louis, Missouri with U.S. Representative (Congressman) Spencer Pettis. Thomas had taken offense to Pettis' criticizing Nicholas at the bank. After an exchange of letters to the editor of a newspaper, Biddle accosted an ill Pettis in his hotel room. After Pettis recovered, he then challenged Thomas to a duel, and both were killed when they exchanged shots from five feet apart.[8]

Bank War[edit]The Bank War began when seventh President Andrew Jackson began criticizing the Bank early in his first term. Biddle, at the urging of Henry Clay and other Bank supporters, upped the ante when he applied for the Bank's re-charter in January 1832.[1] This was four years before the charter was scheduled to expire at the end of two decades, and the hope was to force Jackson into making an unpopular decision that might cost him during an election year. But, once challenged, President Jackson decided to veto the bill anyway. Jackson, well known for his stubborn personality and steadfast leadership, still harbored ill-will toward Henry Clay of Kentucky from the earlier "Corrupt Bargain" accusation following the Presidential Election of 1824 which made him Secretary of State when appointed by the administration of the winner, sixth President John Quincy Adams.At Biddle's direction, the Bank poured thousands of dollars into a campaign to defeat Jackson in the 1832 election. Biddle was told that this would only give credence to Jackson's theory that the Bank interfered in the American political process, but chose to dismiss the warning.[9] Ultimately, Clay's strategy failed, and in November he lost to Jackson, who was reelected to a second term.In early 1833, Jackson, despite opposition from some members of his cabinet, decided to withdraw the Government's funds from the Bank.[10] The incumbent Secretary of the Treasury, Louis McLane, a member of Jackson's Cabinet, professed moderate support for the Bank. He therefore refused to withdraw the Federal funds directed by the President and would not resign, so Jackson then transferred him to the State Department.[11] McLane's successor, William J. Duane, was also opposed to the Bank, but would not carry out Jackson's orders either. After waiting four months, President Jackson summarily dismissed Duane, replacing him with Attorney General Roger B. Taney as a recess appointment when Congress was out of session.[12] In September 1833, Taney helped transfer the public deposits from the Bank to seven state-chartered banks. Faced with the loss of the Federal deposits, Biddle decided to raise interest rates and deliberately induce a recession. A mild financial panic ensued from late 1833 to mid-1834.[13] Intended to force Jackson into a compromise, the move backfired, increasing anti-Bank sentiment.[14][13] Meanwhile, Biddle and other Bank supporters attempted to renew the Bank's charter through the Congress on numerous occasions. All their attempts failed under the threat of a Jackson presidential veto.[13]Demise of the bank[edit]Finally, after the requisite twenty-year term, the Bank's charter expired in April 1836, but the financial institution continued as a state-chartered bank under the laws of Pennsylvania for several more years. As the Bank wound up its operations in the next five years, state-chartered banks in the West and South relaxed their lending standards, maintaining unsafe reserve ratios and contributing to the Panic of 1837. In 1839 Biddle resigned from his post as bank president, and in 1841, amidst the post-Panic recession, the Bank finally failed. Biddle was arrested and charged with fraud, but was acquitted.[citation needed] He died soon after, on February 27, 1844, [15] while still involved in the ensuing civil suits.